Proof of Income

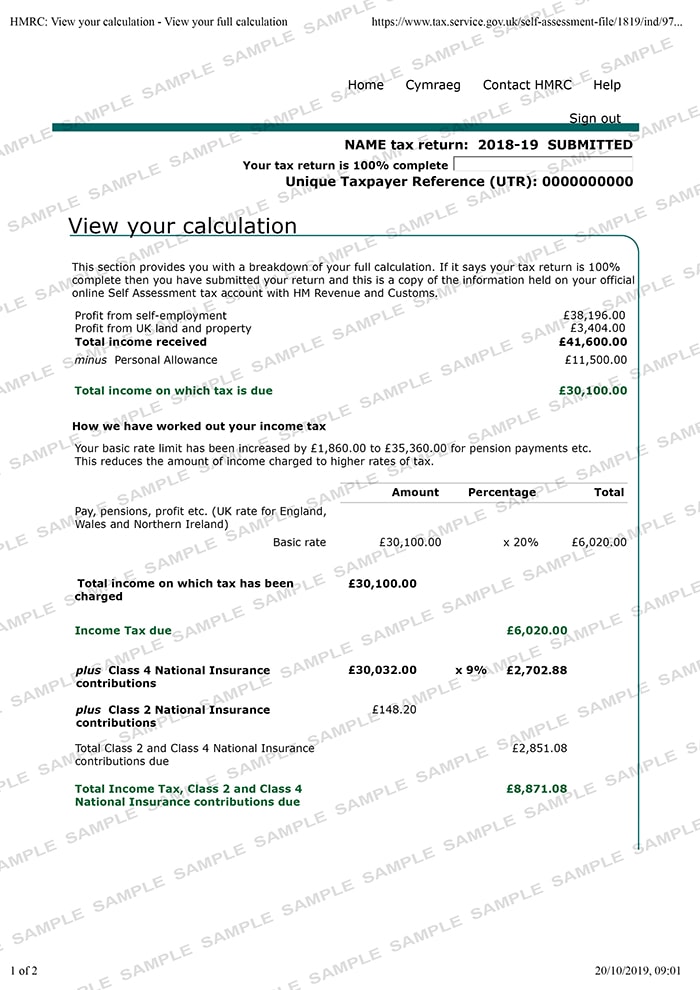

Your income proof is entirely dependant on the role you do, whether you’re employed/self-employed and whether you receive bonuses/overtime or commissions.

Employed Clients

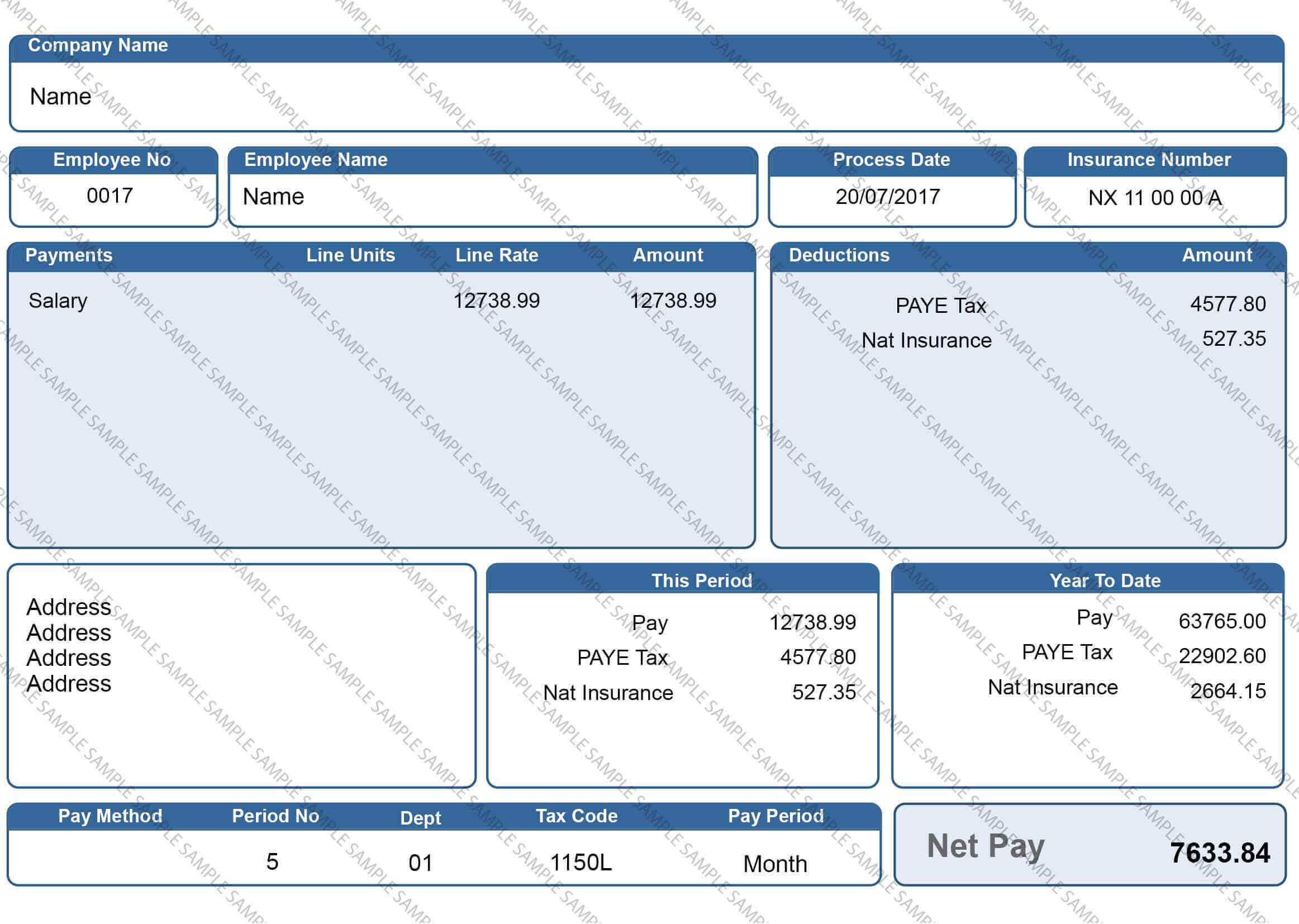

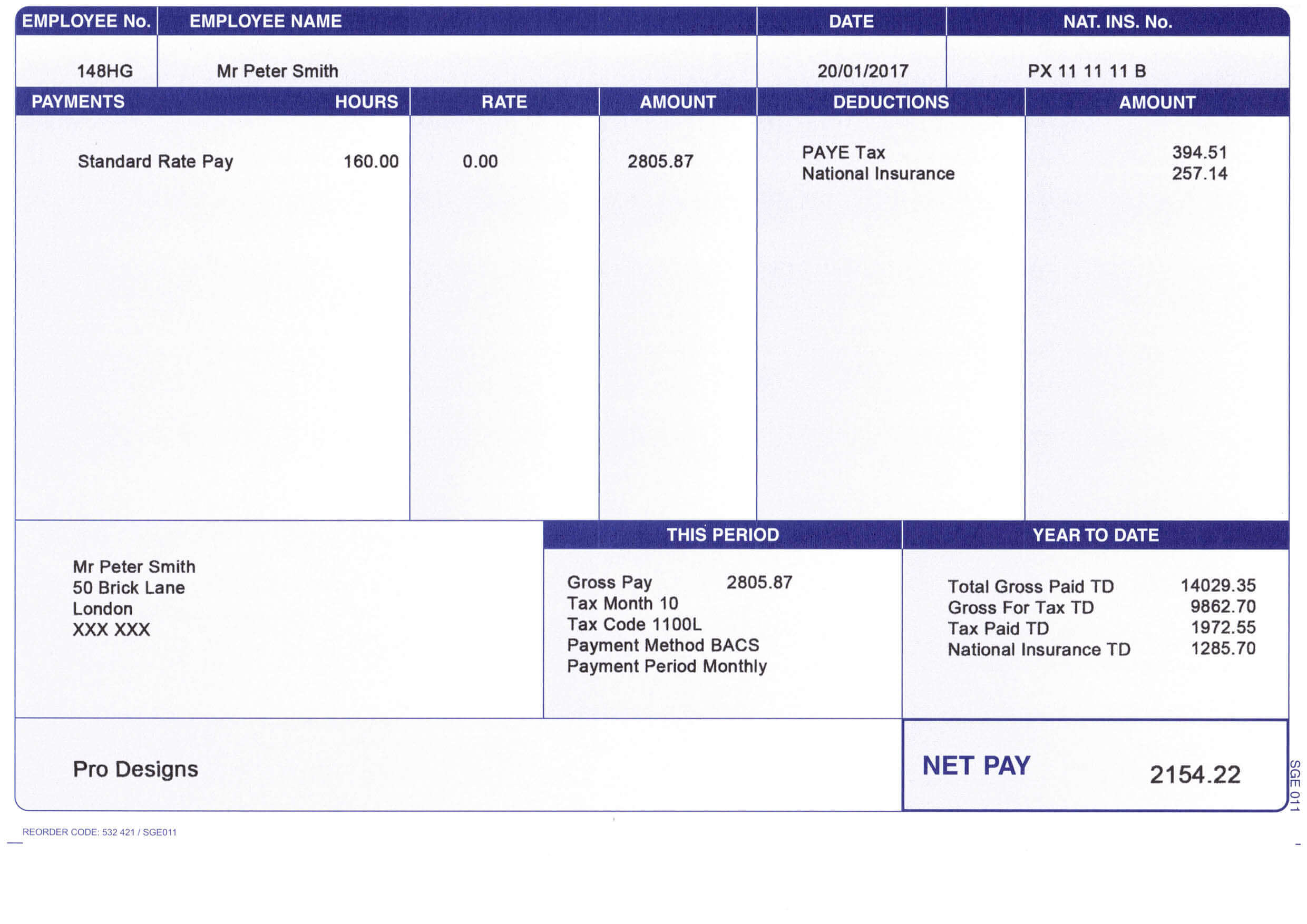

Generally speaking, we would obtain your latest 3 months payslips, this shows a consistent level of pay, and usually, if you have overtime or monthly commission/bonuses, this usually does the trick.

However, where bonus/commissions are paid annually/quarterly of half-yearly. Generally, we would tend to need to evidence at least 2 of these. So, therefore, provide the payslips corresponding to the months that these were paid, in addition to the normal 3 months we require.

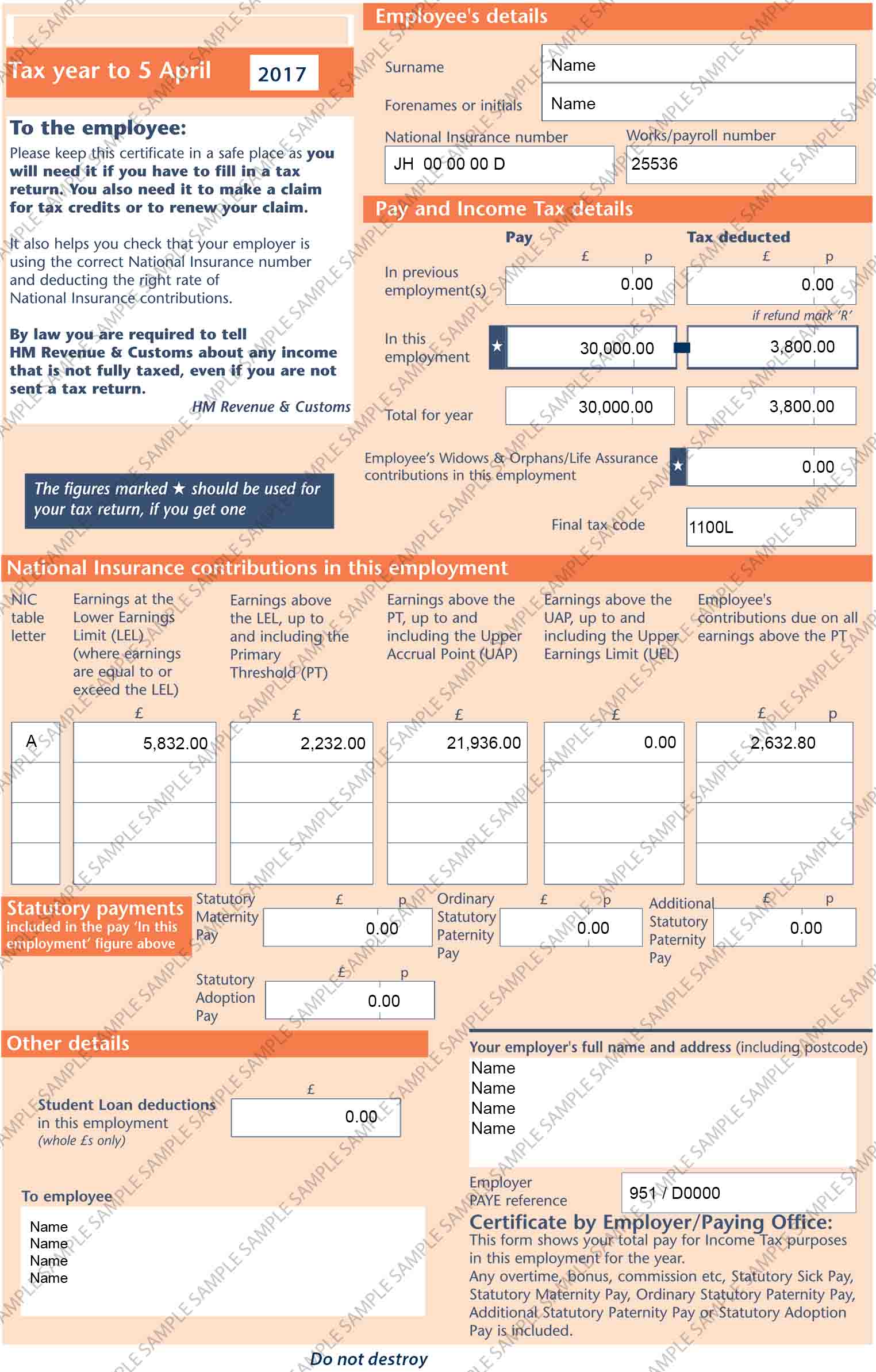

In some occasions, when evidencing additional income such as overtime, lenders may ask for your P60. So it may be a good idea to dig this out of the coffee table filing system in preparation too!

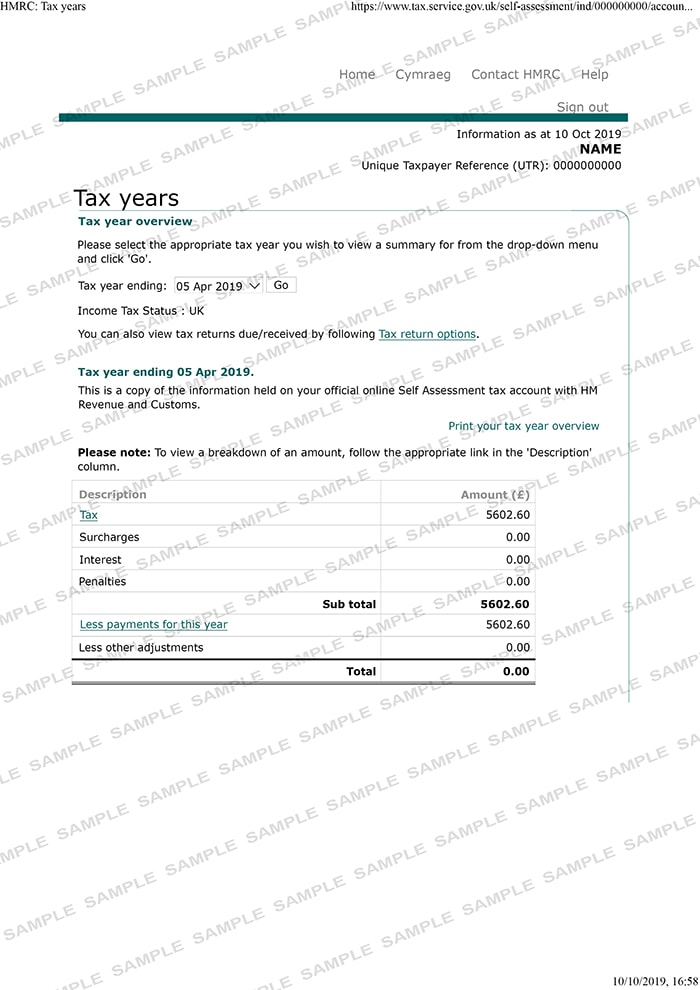

Examples of the formats that lenders would expect are detailed below: