What Do The ‘Levelling Up’ Plans Mean For Landlords?

• Some landlords may face additional costs as Michael Gove, the Housing Minister, aims to improve poor quality private rental homes.

• Many rental properties will require upgrading. The Government announced in their ‘Levelling Up’ White Paper last week they plan to introduce a new minimum standard for private rental properties.

• The White Paper is urging every landlord to go on a Landlord Register and proposes the removal of Section 21 no-fault evictions. This could make it more difficult for you to get possession of your rental property.

The ‘Levelling Up Bill’ is a White Paper. White Papers are policy documents created by the existing Government that set out their future proposals for legislation. Many White Papers don’t even make it to the House of Commons to be debated on, and even then, it needs to be voted on by both Houses of Parliament before becoming law. Any changes are at least two or three years away, and that’s assuming that it gets debated and subsequently approved.

Many have said the White Paper is supposed to lay out how to sort the challenge of rebalancing the UK economy that is suffering from the highest level of regional inequality than any G8 country. This is a huge challenge.

One of the 12 points in the White Paper focused on housing, with a plan to introduce a new minimum standard for rental properties, a landlord register and the removal of no-fault evictions (as an aside, there was also a mention of a possible reintroduction of Home Information Packs – remember those from 2009!).

So, what does this mean for the landlords?

Sub Standard Rental Properties

The proposed changes will mean rental homes in the private sector will have to meet two specific standards that social housing homes currently need to meet.

The first being called the ‘Decent Homes Standard’ (DHS) and the second, the Housing, Health and Safety Rating System (HHSRS) evaluation.

Yet both systems of standards (DHS & HHSRS) have been slated by many (even by the Government itself).

The DHS criteria for the standard are as follows:

1. It must meet the current statutory minimum standard for housing

2. It must be in a reasonable state of repair

3. It must have reasonably modern facilities and services

4. It must provide a reasonable degree of thermal comfort

Note how the word ‘reasonable’ is used in three of the four points of the DHS. Reasonable is an arbitrary and a very much subjective point of view. It screams loopholes and get out clauses to me.

Looking at the HHSRS, the Government announced just before the pandemic in June 2019 that the HHSRS would be revamped after it was found to be ‘complicated and inefficient to use’.

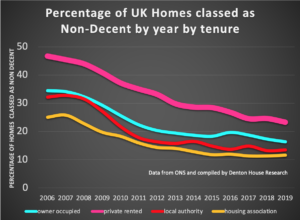

Putting aside how one measures the standards, it is a simple fact that there are many rental properties that are substandard. The Government have an ambition to halve the number of sub-standard private rentals by 2030. However, would it surprise you that in 2006, 46.7% of private rented homes in the UK were classed as substandard and today that has reduced, without any legislation, to 23.3%. One must ask if new legislation is now required?

Previously we discussed that landlords will also be faced with bringing their properties up to an energy rating (EPC) of C between 2026 and 2028 in legislation already announced.

Most of the works to meet that EPC rating requirement will be the same works to meet this new DHS and HHSRS. Also, in that article, we discussed how the Government have suggested that certain allowances will be made for landlords on rental properties that can’t be improved.

So, we think landlords should sit tight and let the Government shine more light on this in the coming months before any knee-jerk reactions are made.

Landlord Register

To be honest, there are several city/borough registers around the UK for landlords. Experience has shown they seem to add an extra level of bureaucracy and red tape. The register would be for every buy-to-let landlord and rogue landlords would be struck off whilst allowing tenants new redress rights. Another reason to employ the services of a letting agent to sort!

End of No-fault Evictions

We also previously spoke about this a few weeks ago with the proposed removal of Section 21 to evict a tenant. If you recall, we stated that no-fault evictions were removed in Scotland over four years ago and the apocalyptic suggestions it would kill the rental market for Scottish landlords was not forthcoming. Now of course, the Scots strengthened the other grounds to evict a tenant. If the Government strengthen the Section 8 legislation, again, we cannot see this being an issue south of the border. Again, time will tell once the Government put more meat on the bones of the White Paper.

Conclusion

Many of the announcements made in the Levelling Up White Paper are re-hashed proposed legislation that has been on the books for the last couple of years.

This White Paper is not another nail in the coffin of buy-to-let.

Yet, many commentators have cautioned that more landlords with substandard homes will sell up because of these proposed changes, warning the sell up would add to the private rental sector’s shortage of homes, thus pushing up rents.

If that was true, that would increase rental returns on buy-to-let and attract more landlords into the sector, wouldn’t it?

But if you don’t agree other landlords will buy these rental properties that other landlords are selling, who will buy their properties from them? It will be renters, who are now able to buy because the price has come down, meaning equilibrium should return to the market.

This is all theoretical and there are shortages/gluts in specific locations. Let us not forget it was 12/18 months ago that rents were dropped by double digit percentage points in the space of a couple of months in the big cities. Those rent drops weren’t anything to do with landlords buying up City Centre rental properties, but demand plummeted with 20 something tenants moving back in with their parents during the first lockdown and the months that followed. Yet, now rents have bounced back to pre-pandemic levels (and more) with the return of tenants to the cities.

In a nutshell, if landlords do end up selling in their droves (which they won’t), yet if they do, those properties will still exist.

Few of them will be left empty because most of them will be bought by other landlords as they will be attracted to the sector as inflation takes hold whilst others will be bought by first-time buyers.

What goes around, comes around. So, let’s see what happens in the coming months. In the meantime, if you’re a landlord and you want to discuss anything in this article, with your local estate agent contact us today.